Market insights

We have all been affected by COVID-19 from the trivial (I cannot get my hair cut) to the much more meaningful (ourselves or loved ones perhaps catching this deadly virus). This one incident has impacted markets more than any other in the past 30 years. What is going on and where we shall be in the future, nobody can say just yet. What we do know, and 90s Eurodance hit singer Haddaway so passionately sung, is that ‘Life will never be the same, life is changing’. It certainly is.

On the economic front, the short-term impact has and will continue to be severe, with most major economies suffering an estimated initial drop in GDP of 20-25%, according to the Organisation for Economic Co-operation and Development (OECD). Globally, the fiscal response has also been dramatic with governments trying to support businesses and markets by opening their coffers. At the end of March, G20 leaders jointly stated that they would pledge vast sums to this end, ‘’We are injecting over USD 5 trillion into the global economy, as part of targeted fiscal policy, economic measures, and guarantee schemes to counteract the social, economic and financial impacts of the pandemic.’’ More recent estimates now put this figure at over USD 6 trillion and close to over 9% of the combined G20 2019 GDP.

Support programmes have helped stock and bond markets regain stability, despite very weak real economic data, as investors look ahead to economies eventually reopening, the development of a vaccine and consumer activity rebounding.

Will all this be enough to rescue the markets? We hope so. Whilst we may not be dancing to the Eurodance beats like Haddaway after bringing life to a rather hot robot (if you fancy a trip down memory lane and a bop around, then the original video of ‘Life’ will do the trick), if policy makers can breathe life back into the economy, we would be grateful, even just for a slow dance.

Irrespective of whether this happens relatively soon, or takes a while longer, we know that the current period of confinement, social distancing and working from home will have long-term impacts on the way we live and work, translating into a whole new investing landscape.

Incorporating the new physical distancing guidelines into safe workplace policies and regulations look to prolong or prevent large company offices from being fully staffed before 2021. The ability to successfully work from home has, despite some initial hiccups, been a pleasant surprise for many employers and employees. It may not fit every job or activity, but for many roles the recent/current experience coupled with the need for companies to change their office usage should lead to more flexible working conditions.

Technology advancements to support that are already in place and have enabled 'digital nomads’ to work from anywhere in the world, providing they have a good internet connection, laptop and telephone. Several large companies have, for some time, provided hot desks for employees who did not need to have permanent desk space, thus reducing costs. Cafes and companies offering flexible office space with high speed internet already exist. Holographic meetings are currently prohibitively expensive, but with time and demand, will doubtless become readily available. This trend of being able to work productively away from the traditional office has accelerated, removing the daily commute for many into city centres as well as saving money for companies who will no longer need as much office real estate.

Travel has all but stopped. In Europe, even with the partial lifting of restrictions, crossing national frontiers within the European Union will remain restricted. Business travel will take many months to recover. With video meetings continuing to embed themselves as acceptable, it may be a long time before we return to previous levels of business travel.

Education may see a shift towards remote learning. Although this may not be the preferred solution for all ages and subjects, with future and perhaps multiple infection waves a possibility, this may well become a necessity and part of normal learning.

Consumer online spending and home deliveries have soared during the confinement and even as the shops begin to reopen our online habits will not diminish.

Environmental upside surprises have been welcomed with the big jump in air quality due the drop in travel and global industrial production (and its associated reduction in power and transportation requirements). The need for employment and an expected pick-up in consumption will see much of this reversed, but politics in many countries has become greener and environmentally positive policies may accelerate with government spending plans when they become more focussed on the economic recovery phase.

We should expect a large pickup in technology investment. Whether this is directed to Big Data and the ability of computers to process large amounts of information quickly; to enhancements in medical research and equipment; the way we use existing knowledge differently; towards the improvement of telecommunication infrastructure and the arrival of 5G; or to the Internet of Things, this investment will speed up the rate of how technology will impact our lives. Safety, security and privacy will be required to constantly improve and keep pace with these expected changes.

The digitalisation of economic activity has seen questions over where international companies pay taxes on their profits and whether an International Corporate Tax reform will be necessary or if we will see more Trump style ‘trade discussions’ with their associated imposed import tariffs. Will automation and robot machines replacing factory workers or computers answering telephones in call centres be taxed as human workers? Will we see more discussion or implementation of a guaranteed minimum income, or a further rise in political populism? Governments will have to walk a delicate line given their need to increase tax revenue to counter extensive investments in economic and health programmes COVID-19 has instigated.

Potential for increased productivity, accuracy and flexibility may not be viewed by all as a necessarily positive changes, but if these changes are publicly and politically acceptable and can bring positive enhancements to the way we live and work then we can also look forward to many new and interesting opportunities.

Dare I say it? Now for a glance at April’s numbers, before we look at the months to come and V3’s position:

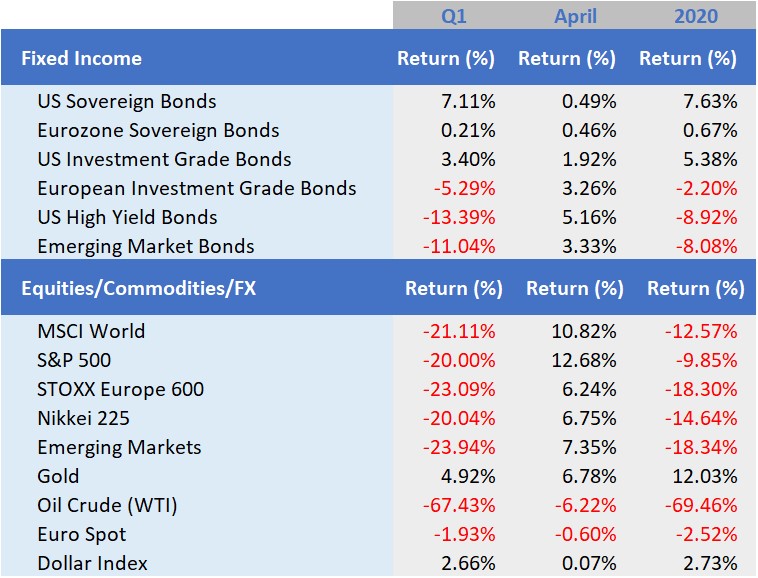

- Developed market equities produced stellar returns following the terrible first quarter losses. The G20 Leaders joint commitment to do whatever it takes and their USD 5 trillion fiscal plans stimulating investors demand. Despite these strong moves, equity indices still have heavy losses for the year. In April the S&P500 gained 12.68% in the United States, the STOXX Europe 600 gained 6.24% and in Japan, the Nikkei 225 gained 6.75%. Globally, as measured by the MSCI World Index, the economy gained 10.82% in April.

- Fixed income markets also witnessed big moves in high yield and emerging markets as strong demand in the last few days of March continued through April. Central bank purchase and support programmes steadied investor nerves and buyers returned. Developed Market Sovereign Bonds held onto their gains for the year. US and Eurozone Sovereign Bonds were 0.49% and 0.46% higher respectively. US Investment Grade Bonds were up 1.92% and the European Investment Grade Bonds were up 3.26%. US High Yield Bonds were 5.16% higher and Emerging Market Bonds up 3.33%.

- Oil prices continued their recent volatility. Despite a deal by OPEC (Organization of the Petroleum Exporting Countries) plus friends, including Russia, to cut production by almost 10 million barrels per day, prices fell further amid storage concerns and the reality of the current economic downturn. WTI’s June contract traded down to USD 11 before rebounding to USD 20. The expiry of the May futures on 21st April saw prices trade below zero as contract holders did not want to take physical delivery. The end of April witnessed US producers also cutting production which further supported more positive sentiment.

- Gold held up well during April, despite jewellery demand weakening, with gold rising 6.78% in the month, up 12.03% for 2020. This was thanks to large investment inflows and positive sentiment. The backdrop of very low and negative short-term rates and government bonds, large fiscal spending and a perception that gold can be used as a valid diversifier in portfolios have all contributed to its gains.

Global markets in numbers

Market Outlook and V3´s position

With the staggered reopening of economic and social activity globally, possible further waves of infection and a vaccine unlikely before summer 2021, we remain cautious in our asset allocation. With better preparedness and more testing to track new cases quickly we might expect a steady pick-up in economic activity. However even with a strong rebound later in the year, it will be from low levels, which will make returning to levels of global economic activity similar to those at the end of 2019 no mean feat.

The recent strong rebound in risk assets leaves little obvious value for investors and should be viewed with caution. Buying of corporate bonds by central banks has helped to calm markets but has also created the risk of price distortions. The presence of such a large buyer raises the possibility the market is mispricing the implicit corporate health of an issuer. Spreads appear to have narrowed more than the current economic environment would otherwise suggest and it is therefore even more important than normal to be very comfortable with the company name, business, sector and relative position in its market when investing.

We continue to believe that the G20 and other governments will provide ongoing support for the economy, and therefore anticipate that any future sharp falls in asset markets will be met with new coordinated central bank support, and look to these potential setbacks to layer more risk into the portfolios.

Structurally we expect to see companies within the technology sector and companies embracing technology to benefit from higher investment demand and deliver better investment returns.

As always, risk appetite will ultimately be the principal guide and it is our perception of risk that drives our choices. We remain vigilant and will monitor the news flow and price movement to look for a potential shift in portfolio positioning, and as always recommend maintaining diversified holdings to assist in reducing overall portfolio risk.

It is not quite upbeat Eurodance, but we’ll get there, and enjoy pulling some moves on the way.

For more information, please contact our Chief Investment Officer, Tom Milner, on:

+41 22 715 0910

tom.milner@v3cap.com

Cover image: Shutterstock