Market insights

As we teeter on the edge of irreversible climate damage, with fires ravaging Australia, volcanos exploding and passenger airplanes being shot out of the sky, it might feel like we are entering an age of darkness. As Charles Dickens so aptly puts it in A Tale of Two Cities that is only half the story:

‘It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness […] we had everything before us, we had nothing before us’

We are indeed living exceptional times, with technology pushing us forward at an incredible speed, democratising access to information and bringing innovation and luxury befitting of kings in bygone eras to our everyday lives. On the other side, we are still witnessing the worst in humanity in events such as with wars, terrorism, refugees and the global climate crisis. Indeed it is the best of times and the worst of times…

In markets, as in life, we went through the best and worst last year. Many crises were close to unfolding, only to be averted by the strong hand of expansionary monetary policy and some well-timed tweets from influential figures (no need to name names, you all know who I am talking about). December was no different, with many investors conservatively prepared for the worst, only to be greeted by an upward moving market that pushed equity indexes to record highs.

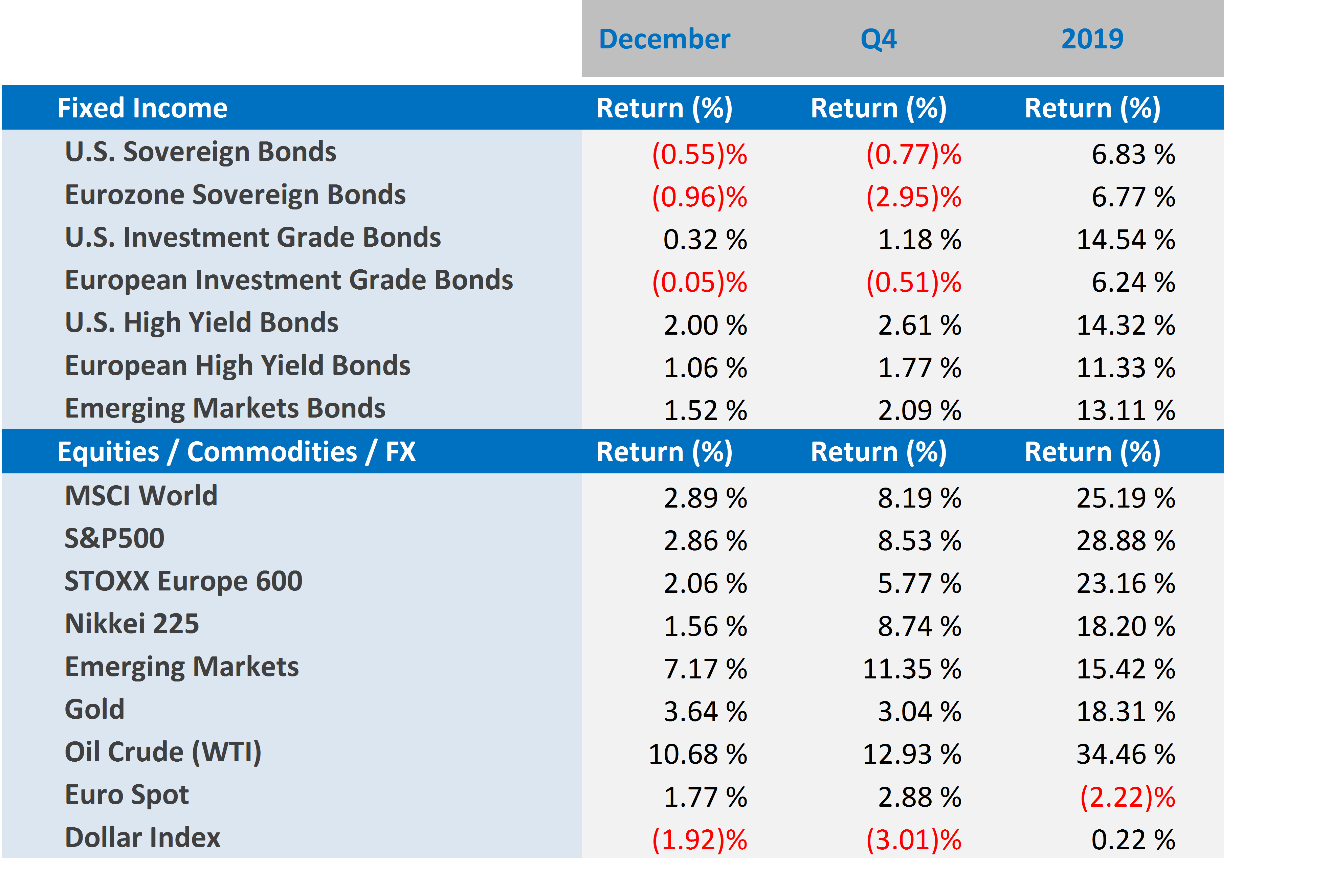

- Developed market equities had another strong month, capping off a great quarter and year. Investors priced in better prospects regarding the US-China trade negotiations and the possible signature of a ‘phase one’ agreement in early January, ignoring President Trump’s impeachment during the month. The S&P500 gained 2.86% in the United States, the STOXX Europe 600 gained 2.06% and in Japan, the Nikkei 225 gained 1.56%.

- Fixed income markets had yet another mixed month, with riskier assets clearly outperforming safer alternatives as investors continued to believe that interest rates would stay low for a while in developed markets. US Treasuries lost 0.55%, US investment grade bonds gained 0.32% and US high yield bonds ended the month up a whopping 2.00%. In Europe, sovereign bonds lost 0.96% and investment grade bonds lost 0.05%, while European high yield bonds gained 1.06%.

- Emerging markets had a strong month, as better news coming from the US-China trade negotiations outshined any negative news and the weaker US Dollar gave a boost to local currency prices. EM equities jumped by 7.17%, while EM bonds gained a respectful 1.52%.

- Oil prices had a very strong month, climbing 10.68% on the back of a renewed agreement between OPEC and Russia to cut oil production to increase prices.

- Gold gained 3.64%, climbing to a three-month high to clinch its best annual performance since 2010, as a weaker dollar helped cap a year marked by global economic jitters and trade frictions.

Global markets in numbers

Market Outlook and V3´s position

Life is full of contradictions and technology, a theme close to my heart, embodies this perfectly. We are indeed living incredible times, witnessing advances we could not even have imagined possible in our lifetimes. Ironically, those same advances and luxuries (e.g. smart phones and laptops) have us enslaved - glued to our screens for hours each day, increasingly living, and damaging, our lives through them. If this is not a huge contradiction, I don’t know what is!

Returning to the markets, we can spot the same kind of contradictions. If we look back over the past decade or so since the end of the 2008 financial crisis, economic growth and market performance has been mostly driven by ultra-low interest rates - the result of a concerted (albeit for most part not officially agreed on) effort by central banks to keep borrowing costs low enough to jump-start economies through cheap cash. Although it is undeniable that this worked pretty well at the height of the financial crisis (when a shock was needed to break the vicious cycle that markets and the economy were going through), we are now under very different conditions. Despite this, we have grown so used to negative interest rates that even the thought of going back to a more normal interest rate regime has the power to derail markets and bring the risk of major corrections to the table.

Investors should remain cautious as mounting risks are threatening this ‘low interest rate euphoria’. One being that, even if Trump’s impeachment is not approved by the US Senate, the fact that the articles of impeachment were approved by the House of Representatives could do enough damage to tip the presidential campaign in favour of the Democratic candidate and a progressive US government. Something markets currently do not seem prepared for.

A more explosive risk is the rapid escalation in tensions in the Middle East after clashes between the US and Iran-backed militias at the end of 2019. This led to a tentative of invasion of the US embassy in Bagdad and culminated with a drone attack that killed Iranian General Qassim Suleimani, commander of the Islamic Revolutionary Guard Corps (IRGC)’ Quds Force and one of the most influential figures in the country. Although, so far, markets have pretty much shrugged off any fears of a major open conflict, there is a serious risk that Suleimani’s death will change the balance of forces in the Middle East, with a non-negligible risk that the US will lose even more influence in this important region.

Our current asset allocation remains unchanged, on the basis of market prices and potential upside (risks aside, of course). Decreased tensions between the US and China should keep supporting, if not pushing up, equity markets.The low ‘forever’ monetary policy is not expected to change meaningfully in the near-term and should keep bond investors happy to take on credit risk. Emerging markets (both equity and debt) should also benefit from the positive outcome of the US/China trade talks, but also from a somewhat weaker US Dollar, coming down after years of appreciation.

Increased risks, however, mean that we should not ignore any potential market correction in case the situation in the Middle East worsens, or the Sino-American trade agreement fails. We also cannot forget unforeseen risks which can and will arise in the future. As a result, for now, our hedges will remain in place, giving peace of mind to investors who are eager to preserve their returns after 2019 gave them one of the best performances in the last 10 years.

Time will tell if 2020 will tell a similar tale to last year and whether it will be the best of times, or the worst of times.

For more information, please contact our Chief Investment Officer, Cássio H. Valdujo, on:

+41 22 715 0910

cassio.valdujo@v3cap.com

Cover image: https://www.shutterstock.com/image-photo/good-day-bad-concept-full-empty-55063612