Market insights

Last year I had the opportunity to eat at a restaurant near Geneva, where a well-known celebrity chef was in charge of the kitchen (oh for the pre-confinement days!). The meal was excellent, the produce fresh and the mix of flavours superb. The chef had used local, national and international ingredients and employed modern day and 100-year-old techniques to produce a wonderful meal.

Combining multiple elements successfully is no mean task. Only time will tell whether central banks and governments have chosen the right recipe to produce the much hoped-for economic rebound following the peak of the current health crisis. Will they be able to mirror this restaurant’s success by drawing from old and new, local and international, and combine that with their own knowledge and experience for a masterpiece in economics?

At V3 we feel that this is a ‘whatever it takes’ moment. Where global authorities will throw away any short-term budget restrictions and turn on the fiscal spending taps alongside any monetary tools and other actions available. The choice of ingredients in their actions and the methods used may not be to everyone’s taste, but the scale of the combined actions are certainly impressive and appear to have tempered investors’ worst fears for now.

We can see that volatility has been trending lower and risk assets have seen buyers return. We also appear to be seeing a sharp, short economic recession beginning to be priced in - questions regarding the strength and durability of the subsequent rebound and potential damage to big banks’ balance sheets are for now, at least, not at the forefront of investors’ concerns.

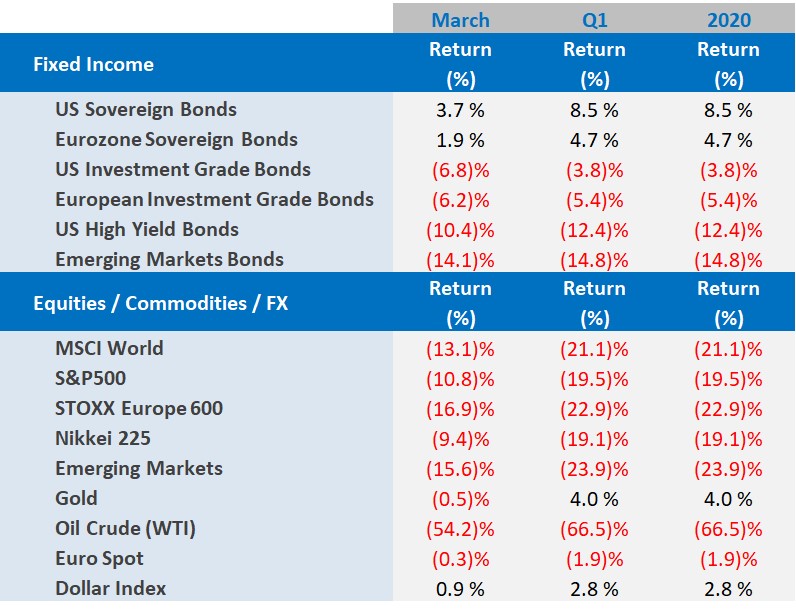

Before we continue looking into the future, let’s have a brief run through of what we have just been through, marketwise…

Whilst we were aware of the potential economic consequences of COVID-19’s impact, we were surprised by the speed of the market reaction. During March, asset price moves seemed to be reflecting a long lasting and damaging economic toll on the global economy. This was caused by a mixture of asset allocators only buying safe haven assets, investors moving to the side lines, profit taking and speculators, all of which severely impacted risk assets.

On top of which, without knowing how the pandemic will impact public health, the economy and therefore asset prices, it is normal that market psychology impacts prices. What troubled us (and you too, I am sure), however, was the degree to which both safe haven and risk assets moved!

- Dramatic negative drops in equities, commodities, high yield and long duration fixed income were mirrored by the strongly positive moves in Developed Market Government Bond prices across the curve. Central bank rate cuts fuelled demand and yields moved lower accordingly. Longer duration and lower credit quality suffered, with large price declines across this area of the market.

- Equity markets were sold-off heavily with several equity indices registering lows over 40% below recent highs, before decent rallies reduced these losses towards the month end.

- Crude oil, already negatively impacted since the start of the year, dropped by half as the self-imposed economic shut down by many of the world’s largest producing and consuming countries was coupled with an ongoing dispute between the Kingdom of Saudi Arabia and Russia (who have been unable to agree on production supply decreases). This double impact hurt the stable, well financed, larger equity listed names as well as the more fragile leveraged ones, driving prices lower, before a selective strong rally later in the month.

- Gold has also been particularly volatile. As expected, prices moved higher with increased health risks up to 24th February. The sell-off we saw at the end of February and again into the middle of March was probably produced by long gold positions liquidating profits, preceded its more recently rally.

Global markets in numbers

Market Outlook and V3´s position

With large parts of the fixed income market supported by central bank action and budget deficits now ignored, we see two potential outcomes: One where economic stimulus does not work, the current sharp recession lasts longer and moves on to a financial crisis, and another where the support and stimulus carries the economy through the current pandemic and produces an economic recovery. V3 sees the recovery as the higher probability outcome.

With Developed Government Bonds offering even lower, and/or still negative yields, it seems that investors will inevitably return to equities in search of returns and yield. It is for this reason, more than any other, that V3 believes that equities will be the best medium-term investment within the major asset classes.

Inflation is often cited as a negative for holders of gold, but inflation will take a while to appear and massive central bank balance sheet expansion should, in theory, devalue currency, which should boost the gold price. In traditionally managed, diversified portfolios, developed Government Bonds act as a defensive part of diversification, although current negative or very low yields force us to question their viability in this regard. We are therefore adding to our Gold positions.

As always, risk appetite will ultimately be the principal guide for any investor and for some of our investors we have increased risk asset exposure during the month, as we felt price moves were overdone.

The exit strategy for the current confinement in place in many countries is not yet clear. Despite this, we believe that we will see a marked economic pick-up in the second half of 2020 and therefore the reduction of very high levels of market volatility.

We remain vigilant and will monitor the news flow and price movements to look for potential shifts in portfolio positioning and recommend maintaining a diversified portfolio to assist in reducing overall portfolio risk.

Here’s hoping that the menu offered by the authorities proves to be digested well. Bon appétit!

For more information, please contact our Chief Investment Officer, Tom Milner, on:

+41 22 715 0910

tom.milner@v3cap.com

Cover image: Shutterstock