Market insights

I have often wondered why those among us, who truly feel the effects of vertigo, would climb all the way up the stairs of a giant waterslide and push themselves (in all senses of the word) to go down. In this case, it appears that the thrill experienced overcomes the fear itself, and it most likely helps when you believe that the ‘fall’ will be controlled and the landing soft. That sense of security allows us to climb the stairs repeatedly and enjoy the ride again and again. Or maybe one ride is enough and you prefer the Jacuzzi – far safer, unless you have a fear of bubbles.

We finished our opening paragraph of January’s Market Insights with, ‘As the month progressed worries of the impact of the Coronavirus outbreak captured everyone’s attention.’ However, it took until the 19th February for equities and other risk assets to start to fall, and the fall was big and fast! It is rare for us to experience a fall of 15% in the S&P 500 index from intraday high to intraday low in

less than 10 days (the last time was back in 2008, during the financial crisis), but the escalating global spread of the new Coronavirus began a series of reductions to global economic growth forecasts and talk of potential recessions in various countries.

The S&P 500 index was just one example of how markets were impacted, we also saw: large negative moves in most equity indices, as well as in oil and industrial commodities, and spreads widening in lower quality fixed income credit. On the flight to safety and defensive positioning, we also saw Developed Market Government Bonds rally aggressively and positive price moves in Gold, the Swiss Franc and Japanese Yen. The USD, which often rallies during defensive market moves, fell - in part due to increased expectations of more aggressive interest rate cuts from the US Federal Reserve.

So, what is the connection between a water slide and asset markets? We all fear an extended fall, not to mention a potential fall without the security of a soft (or wet!) landing – which is the hoped for scenario in this current episode of lower growth and possible recession. Only time will tell us how investors will react if monetary and fiscal responses means that the economic fallout is softened. Will it be enough for them to regain sufficient confidence in their medium-term, if not the short-term, economic outlooks?

Presidents, Prime Ministers, Central Bank Governors, the World Bank, International Monetary Fund and more have all spoken publicly to acknowledge the risks posed by the spread of the Coronavirus to country, regional and global growth. Whilst we do not know what/which policies will finally be used, markets have already priced lower interest rates and it seems likely that other policy measures may be introduced to support the business community.

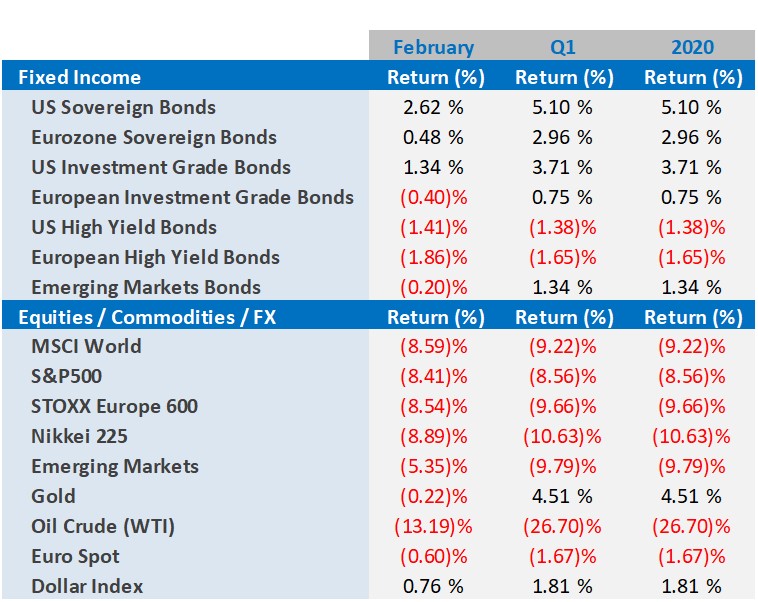

- Developed market equities began the month steady, making positive gains. The focus was on a more dovish US Federal Reserve and low/lower interest rates in general, rather than any particular risk of a global overspill of the Coronavirus. However, as the month progressed, and cases began being detected in other countries, companies began to cancel travel and conferences (here in Geneva the annual car show, normally attracting over 300,000 people, was cancelled) and the potential negative economic impact began to be more widely discussed. Markets started to react and indices fell sharply. The S&P500 lost 8.41% in the United States, the STOXX Europe 600 lost 8.54% and in Japan, the Nikkei 225 lost 8.89%.

- Fixed income markets saw a big differentiation between the safe havens offered by Developed Market Government Bonds (which witnessed big gains and yields dropping – the US 10 Year yield dropped from 1.63% to 1.16%), while High Yield Bonds suffered as spreads widened on pessimistic economic worries. US Treasuries gained 2.62%, US investment grade bonds gained 1.34% and US high yield bonds lost 1.41% In Europe, sovereign bonds gained 0.48% and investment grade bonds lost 0.40%, while European high yield bonds lost 1.86%.

- Emerging markets were also impacted by the fears over the Coronavirus outbreak with equities and fixed income markets following a similar global pattern. EM equities lost 5.35%, while EM bonds lost 0.20%.

- Oil moved with other economically exposed markets, initially rallying and subsequently falling back on similar fears that drove equity markets lower later in the month. Oil Crude (WTI) lost 13.19%.

- Gold as a safe haven initially rallied to be up over 6%, before profit taking took the price back to almost flat for the month, losing 0.22%.

Global markets in numbers

Market Outlook and V3´s position

Coronavirus and its unknown future path (and therefore potential to impact the economic growth and inflationary shorter, and medium, expectations) contributed heavily to an already complicated mix.

The duration of the ability of the virus to spread will have a direct impact on the length of time this slowdown to economic activity will last. Will the various current containment exercises slow sufficiently its progress and will the warmer Northern Hemisphere weather in the coming months also slow the virus spread?

Asset Markets are telling differing stories. Developed Government Bonds are indicating a far higher risk of a more severe economic growth slow down and possible recessionary outcome. Meanwhile, equities and lower quality fixed income markets are not pricing in such a significant risk. We sense the actual risk is somewhere between these two.

There is no immediate answer, however it does appear highly likely that Government and Central Bank support will be forthcoming to create a less damaging downside scenario and endeavour to encourage a subsequent economic pick-up.

Whilst significantly encouraged by policy makers’ public statements, we feel that the asset markets need to see the containment exercise successfully leading to a reduction in the numbers of new virus cases before any high degree of confidence can return. As such, we are currently recommending relatively defensive positioning in portfolios.

We have already reduced equity exposure and selectively added equity index put protection, as well as reduced Fixed Income duration and carefully selected credit names. Gold is recommended as a diversifier and we do not yet feel comfortable entering any new industrial commodity positioning.

As always, risk appetite will ultimately be the principal guide and it is our perception of risk that drives our choices. We remain vigilant and will monitor the news flow and price movement to look for a potential shift in portfolio positioning, and as always recommend maintaining diversified holdings to assist in reducing overall portfolio risk.

We are heading down the slide right now, though you can be certain that we shall be climbing those stairs up to the top to do it all over again.

For more information, please contact our Chief Investment Officer, Tom Milner, on:

+41 22 715 0910

tom.milner@v3cap.com

Cover image: Shutterstock